There’s no denying the AI boom. But behind the slick demos, jaw-dropping capabilities, and ever-expanding hype sits a nagging question: how will any of this actually pay off?

Our team dug into OpenAI’s financial model—and whether the company’s ambitious plans make business sense. Spoiler: the jury’s out.

Let’s start with the numbers. OpenAI, the maker of ChatGPT, is reportedly on track to reach $1.3 billion in revenue this year, largely from premium subscriptions and enterprise deals. That’s a respectable haul for a company that didn’t even have a significant product on the market three years ago. But it’s a drop in the bucket compared to the $1.5 trillion it claims it will invest in infrastructure over the next decade—a number that dwarfs even the riskiest bets in Silicon Valley history.

Let’s be clear: this is the most significant financial commitment in the history of AI.

That money is earmarked for chips, datacenters, and compute infrastructure, much of it supplied by juggernauts like NVIDIA, Broadcom, Oracle, and Amazon Web Services, whose stock prices have already been buoyed by the announcement. But here’s the catch: OpenAI doesn’t actually have that cash. Not yet, anyway. And it doesn’t currently have a reliable path to generate it.

At the time of writing, OpenAI’s valuation is speculated to be pushing toward $100 billion, and there’s talk of an IPO down the road. Some reports have even suggested it could aim for a trillion-dollar market cap someday. But here’s where things get shaky: 95% of ChatGPT users are still on the free tier. That’s right—only 4 million out of roughly 800 million users are paying $20–$30 a month for access to GPT-5 or enterprise-grade tools.

OpenAI’s current business model hinges on the freemium playbook: hook users with free access and convert power users into subscribers. But is that enough to support trillion-dollar infrastructure dreams? It wasn’t for most dot-com darlings in 2000, and many analysts are now drawing stark comparisons between today’s AI market and the pre-crash days of the internet bubble.

And it’s not just about subscribers. OpenAI knows that subscriptions alone won’t cut it, which is why we’re seeing a shift in the platform’s behavior.

OpenAI recently restricted access to medical and legal advice, likely as a precautionary measure due to liability concerns. But don’t be surprised if this opens the door for premium verticals like ChatGPT Health or ChatGPT Legal—fee-based services backed by licensed professionals or fine-tuned models for specific fields. The structure is already there; they just need to flip the switch.

And then there’s advertising and affiliate commerce. Walmart has partnered with ChatGPT to guide users from AI suggestions to real-world purchases. It’s easy to imagine a future where every answer includes a sales pitch:

“Here’s how to fix your dishwasher—and here’s a link to one on sale at Walmart. Click here.”

Just like Google before it, ChatGPT’s responses will eventually be monetized. This isn’t speculation. This is inevitable.

But as Aware Force’s CEO, Richard Warner, pointed out, there’s a critical trade-off at play:

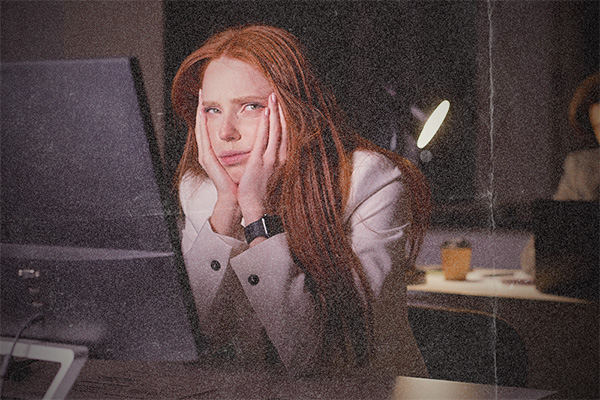

“Bad content always drives out good.”

The moment OpenAI prioritizes monetization over accuracy, user trust will decline. Just as Google’s search results became bloated with SEO-choked garbage over time, AI could suffer a similar fate if financial pressure forces it to promote sponsored or affiliate-laced results.

And that’s dangerous, given that it’s a tool people use for everything from business analysis to healthcare to parenting advice. With ChatGPT already wrong 20%–40% of the time in technical queries, injecting commerce into its answers could turn it from a helpful assistant into a liability.

That depends on your definition of sustainable.

If OpenAI can:

…then sure, maybe. But that’s a lot of ifs, and the clock is ticking.

The infrastructure bets have already been made. The valuation hype has already been priced in. The commercial partnerships have already been announced. Now, OpenAI has to deliver.

Because if it doesn’t?

We’ve seen it before.

At Aware Force, we help large organizations educate and engage employees on cybersecurity through powerful branded content. From interactive videos to bite-sized newsletters and cyber games that spark curiosity, we create experiences that stick—and change behavior.

The Information, Bloomberg, Futurism, Financial Times, Walmart, Yahoo Finance